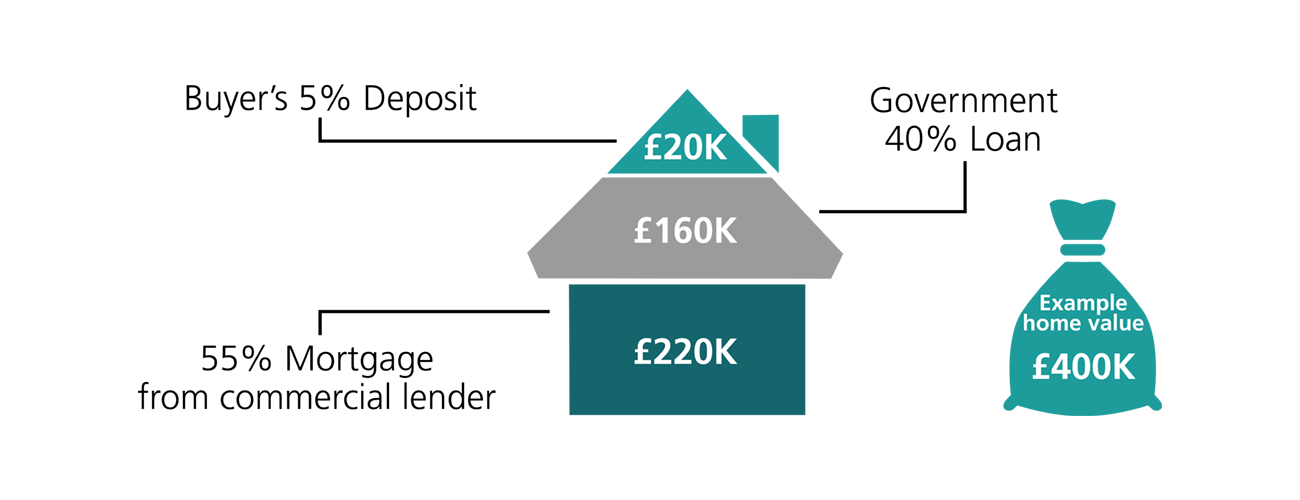

London Help to Buy is a government scheme designed to help you to get on to the property ladder in the London area. Help to Buy is an equity loan from the government of up to 40% of the value of the property you wish to buy, provided you have a 5% deposit, therefore requiring only a 55% mortgage on your new home.

To use London Help to Buy, the property you are buying must:

• Be a new build

• Have a purchase price of up to £600,000

• Be the first property you own

• Not be let or sublet once purchased

• You must pay the loan back after 25 years or when you sell your home whichever comes first

• You will not be charged interest on your 40% loan for the first 5 years of owning your home

• After 5 years, a monthly interest fee of 1.75% is payable on the equity loan (rising annually by the CPI (Consumer Price Index) plus 2%.

You apply directly to the house builder for the loan and then apply separately for a mortgage via your chosen lender or mortgage broker, letting them know you intend using the London Help to Buy scheme.

For more information or to discuss your options please contact us in the first instance or visit: